| A: | If your Shares are registered in your name, they will not be revoked ifvoted unless you attendsubmit your Proxy or vote in person at the Meeting but do not vote. Meeting. If you own your Shares through a brokerare held in street name, your broker/dealer or other nominee and wishwill not have the authority to changevote your Shares unless you provide instructions. If you do not instruct such broker/dealer or other nominee as to how to vote you must send those instructionsyour Shares, NASDAQ rules allow such nominee to vote your broker or nominee. Q: | Will my Shares be voted if I do not sign and return my Proxy?

|

| A: | If your Shares are registered in your name, they will not be voted unless you submit your Proxy or vote in person at the Meeting. If your Shares are held in street name, your broker/dealer or other nominee will not have the authority to vote your Shares unless you provide instructions. If you do not instruct such broker/dealer or other nominee as to how to vote your Shares, NASDAQ rules allow such nominee to vote your Shares only on routine matters. Proposal 2, the ratification of the selection of the Company’s independent registered public accounting firm for fiscal 2019,Shares only on routine matters. Proposal 2, the ratification of the selection of the Company’s independent registered public accounting firm for fiscal 2020, is the only matter for consideration at the Meeting that NASDAQ rules deem to be routine. For all other proposals, you must submit voting instructions to the nominee that holds your Shares if you want your vote to count.

|

| Q: | Who will count the votes? |

| A: | Agents of the Company will tabulate the Proxies. Additionally, votes cast by Shareholders voting in person at the Meeting are tabulated by a person who is appointed by our management before the Meeting. |

| Q: | How many Shares must be present to hold the Meeting? |

| A: | To hold the Meeting and conduct business, at leastone-third of the outstanding Shares entitled to vote at the Meeting must be present at the Meeting. This is called a quorum. |

Votes are counted as present at the Meeting if a Shareholder either: | ● | | is present and votes in person at the Meeting; or has properly submitted a Proxy. Abstentions and brokernon-votes (i.e., Shares held by a broker/dealer or other nominee that are not voted because the broker/dealer or other nominee does not have the authority to vote on a particular matter) will be counted for the purposes of determining the presence of a quorum. | Q: | How many votes are required to elect directors? |

| A: | The affirmative vote of a majority of the Shares voted at the Meeting is required to elect our directors. However, our Governance Guidelines provide that in uncontested directors’ elections any nominee for director who receives more votes “Withheld” than “For” for his or her election will have his or her term as a director terminate on the earlier to occur of: (i) 90 days after the election results are certified; (ii) the date such director resigns; or (iii) the date the Board fills the position. |

| Q: | How many votes are required to adopt the other proposals? |

| A: | The ratification of the appointment of PricewaterhouseCoopers LLP and thenon-binding approval of the compensation of our executive officers named herein will require the affirmative vote of a majority of the Shares represented at the Meeting and entitled to vote thereon. |

| Q: | What is the effect of withholding votes or “abstaining”? |

| A: | You can withhold your vote for any nominee in the election of directors. Withheld votes will be excluded entirely from the vote and will have no effect on the outcome (other than potentially triggering the majority voting requirements set forth in our Governance Guidelines and as described above). On other proposals, you can “Abstain”. If you abstain, your Shares will be counted as present at the Meeting for purposes of that proposal and your abstention will have the effect of a vote against the proposal. |

| ● | | has properly submitted a Proxy.

|

Abstentions and brokernon-votes (i.e., Shares held by a broker/dealer or other nominee that are not voted because the broker/dealer or other nominee does not have the authority to vote on a particular matter) will be counted for the purposes of determining the presence of a quorum.

Q: | How many votes are required to elect directors?

|

A: | The affirmative vote of a majority of the Shares voted at the Meeting is required to elect our directors. However, our Governance Guidelines provide that in uncontested directors’ elections

|

| any nominee for director who receives more votes “Witheld” than “For” for his or her election will have his or her term as a director terminate on the earlier to ocur of: (i) 90 days after the election results are certified; (ii) the date such director resigns; or (iii) the date the Board fills the position.

|

Q: | How many votes are required to adopt the other proposals?

|

A: | The ratification of the appointment of PricewaterhouseCoopers LLP and the non-binding approval of the compensation of our executive officers named herein will require the affirmative vote of a majority of the Shares represented at the Meeting and entitled to vote thereon.

|

Q: | What is the effect of withholding votes or “abstaining”?

|

A: | You can withhold your vote for any nominee in the election of directors. Withheld votes will be excluded entirely from the vote and will have no effect on the outcome (other than potentially triggering the majority voting requirements set forth in our Governance Guidelines and as described above). On other proposals, you can “Abstain”. If you abstain, your Shares will be counted as present at the Meeting for purposes of that proposal and your abstention will have the effect of a vote against the proposal.

|

| A: | You may vote “For” or “Withhold” your vote on the proposal to elect directors. You may vote “For” or “Against” or “Abstain” on the proposals to ratify the selection of our independent registered public accounting firm and approve the compensation of our executive officers named herein. If you withhold or abstain from voting on a proposal, it will have the practical effect of voting against the proposal. |

If you sign and return your Proxy without voting instructions, your Shares will be voted in accordance with the Board’s recommendations for the proposals described in this Proxy Statement. | Q: | Could other matters be discussed at the Meeting? |

| A: | We do not know of any other matters to be brought before the Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Meeting for consideration, the persons named in the Proxy will have the discretion to vote on those matters on your behalf. |

Q: | Where and when will I be able to find the voting results?

|

A: | You can find the official results of voting at the Meeting in a current report on Form8-K filed with the SEC within four business days of the Meeting.

|

Even if you plan to attend our annual meeting in person or through the virtual meeting, please cast your vote as soon as possible by:

| | | | | | | | |

| | using the Internet at

• www.investorvote.com/merc

(for registered shareholders)

• www.proxyvote.com

(for beneficial shareholders)

| | | |

| | calling toll-free1-800-652-VOTE (8683) within the United States, U.S. territories and Canada

|

| | scanning the QR code provided in your proxy with your smartphone

| | | |

| | mailing your signed proxy or voting instruction form

|

FUTURE SHAREHOLDER PROPOSALS

Any proposal which a Shareholder wishes to include in the proxy statement and proxy relating to the 2020 Annual Meeting must be received by the Company on or before December 17, 2019. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with Rule14a-8 under the Exchange Act and all other applicable requirements.

Shareholders wishing to bring any other item before the 2020 Annual Meeting, other than in accordance with the process of Rule14a-8 under the Exchange Act, must submit written notice of such proposal to

the Company no earlier than January 31, 2020 and no later than March 2, 2020. If the Company receives notice of a Shareholder proposal after March 3, 2020, such notice will be considered untimely and the Company’s management will have discretionary authority to vote proxies received with respect to such proposal.

Please direct any proposal or notice of intention to present a proposal to the care of the Secretary, Mercer International Inc., Suite 1120, 700 West Pender Street, Vancouver, B.C., Canada V6C 1G8.

OTHER MATTERS

The directors know of no matters other than those set out in this Proxy Statement to be brought before the Meeting.Meeting other than those referred to in this Proxy Statement. If other matters are properly come beforepresented at the Meeting it isfor consideration, the intention ofpersons named in the proxy holdersProxy will have the discretion to vote on those matters on your behalf.

|

| Q: | Where and when will I be able to find the Proxies received forvoting results? |

| A: | You can find the official results of voting at the Meeting in accordancea current report on Form8-K filed with their judgment. Notice Regarding Forward-Looking Statements

This Proxy Statement includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Statements herein that describe ourSEC within four business strategy, plans, goals, future capital spending levels and potential for growth, improved profit margins and cash generation are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results and amounts to differ materially from those in forward-looking statements. For a detailed discussiondays of the risksMeeting.

|

Even if you plan to attend our annual meeting in person or through the virtual meeting, please cast your vote as soon as possible by: | | | | | | | | | | |  | | using the Internet at • www.investorvote.com/merc (for registered shareholders) • www.proxyvote.com (for beneficial shareholders) | |

| | calling toll-free1-800-652-VOTE (8683) within the United States, U.S. territories and uncertainties, seeCanada | | | | |  | | scanning the “Risk Factors” discussionQR code provided in Item 1A of our 2018 Annual Report.your proxy with your smartphone | |  | | Date: April 16, 2019

The forward-looking statements included in this Proxy Statement are made only as of the date of this Proxy Statement and we undertake no obligation to update the forward-looking statements to reflect subsequent eventsmailing your signed proxy or circumstances.voting instruction form

This Proxy Statement and our 2018 Annual Report are available at www.mercerint.com. Copies of our 2018Form 10-K, may be obtained from Mercer International Inc. Attention: Shareholder Information, Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada V6C 1G8 (Tel: (604)684-1099). This Proxy Statement and our 2018 Form10-K are also available on the SEC’s website at www.sec.gov and on our website at www.mercerint.com.

Web links and QR codes throughout this document are provided for convenience only, and the content on the referenced websites does not constitute a part of this proxy statement.

|

FUTURE SHAREHOLDER PROPOSALS Any proposal which a Shareholder wishes to include in the proxy statement and proxy relating to the 2021 Annual Meeting must be received by the Company on or before December 11, 2020. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with Rule14a-8 under the Exchange Act and all other applicable requirements. Shareholders wishing to bring any other item before the 2021 Annual Meeting, other than in accordance with the process of Rule14a-8 under the Exchange Act, must submit written notice of such proposal to the Company no earlier than January 29, 2021 and no later than February 28, 2021. If the Company receives notice of a Shareholder proposal after March 1, 2021, such notice will be considered untimely and the Company’s management will have discretionary authority to vote proxies received with respect to such proposal. Please direct any proposal or notice of intention to present a proposal to the care of the Secretary, Mercer International Inc., Suite 1120, 700 West Pender Street, Vancouver, B.C., Canada V6C 1G8. INTERNET VOTING The Company is incorporated under Washington law, which specifically permits electronically transmitted proxies, provided that the transmission must either set forth or be submitted with information from which it can reasonably be determined that the transmission was authorized by the Shareholder. The electronic voting procedure provided for the Meeting are designed to authenticate each Shareholder by use of a control number to allow Shareholders to vote their Shares and to confirm that their instructions have been properly recorded. OTHER MATTERS The directors know of no matters other than those set out in this Proxy Statement to be brought before the Meeting. If other matters properly come before the Meeting, it is the intention of the proxy holders to vote the Proxies received for the Meeting in accordance with their judgment. Notice Regarding Forward-Looking Statements This Proxy Statement includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Statements herein that describe our business, strategy, plans, goals, future capital spending levels and potential for growth, improved profit margins and cash generation are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results and amounts to differ materially from those in forward-looking statements. For a detailed discussion of the risks and uncertainties, see the “Risk Factors” discussion in Item 1A of our 2018 Annual Report. The forward-looking statements included in this Proxy Statement are made only as of the date of this Proxy Statement and we undertake no obligation to update the forward-looking statements to reflect subsequent events or circumstances. This Proxy Statement and our 2019 Annual Report are available at www.mercerint.com. Copies of our 2019Form 10-K, may be obtained from Mercer International Inc. Attention: Shareholder Information, Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada V6C 1G8 (Tel: (604)684-1099). This Proxy Statement and our 2019 Form10-K are also available on the SEC’s website at www.sec.gov and on our website at www.mercerint.com. Web links and QR codes throughout this document are provided for convenience only, and the content on the referenced websites does not constitute a part of this proxy statement. | BY ORDER OF THE BOARD OF DIRECTORS | /s/ Jimmy S.H. Lee | Jimmy S.H. Lee | Executive Chairman |

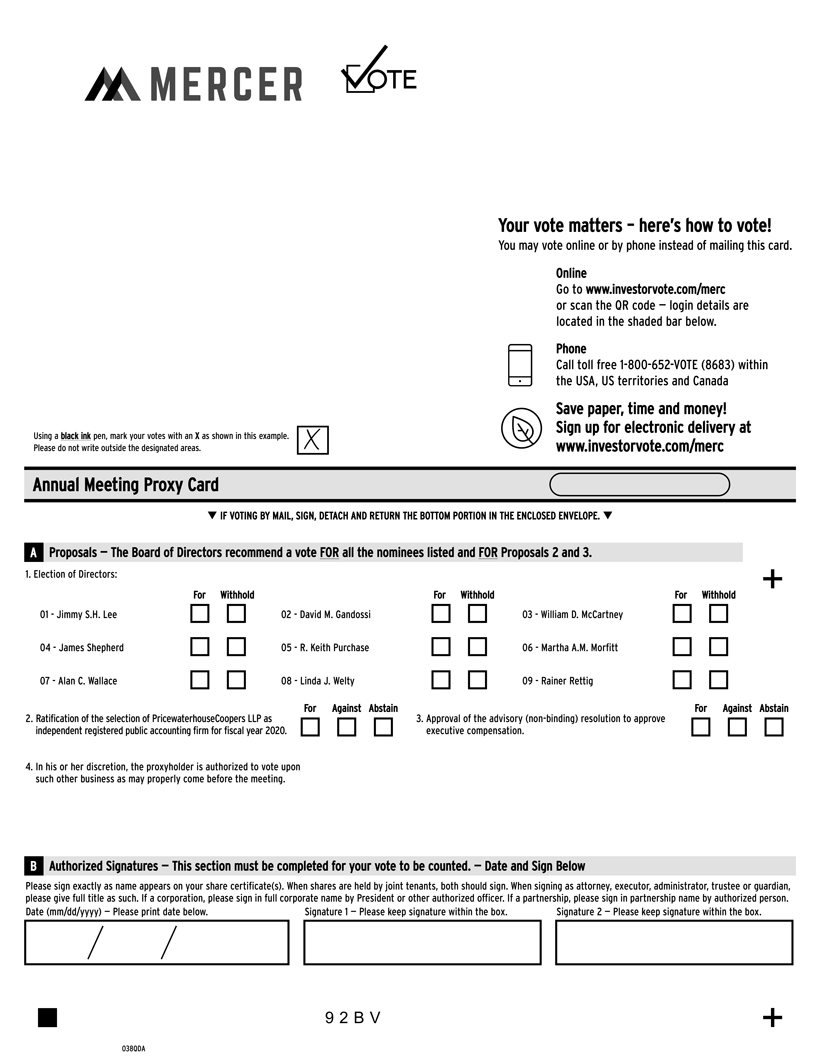

| | | | | Using ablack inkpen, mark your votes with anXas shown in this example.

Please do not write outside the designated areas. | |  | | |

Your vote matters – here’s how to vote!

You may vote online or by phone instead of mailing this card.

| | | | | Online

Go towww.investorvote.com/merc or scan the QR code – login details are located in the shaded bar below.

| | |  | | Phone

Call toll free1-800-652-VOTE (8683) within the USA, US territories and Canada

| | |  | | Save paper, time and money!

Sign up for electronic delivery at www.investorvote.com/merc |

q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.q

| | | | | A | | Proposals – The Board of Directors recommend a voteFOR all the nominees listed andFOR Proposals 2 and 3.

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | 1.

| | Election of Directors:

| | | | | | | | | | | | | | | | | | | | | | | | | | | For

| | Withhold

| | | | | | For | | Withhold | | | | | | For | | Withhold | | +

| | | 01 -Jimmy S.H. Lee

| | ☐ | | ☐ | | | | 02 - David M. Gandossi | | ☐ | | ☐ | | | | 03 - William D. McCartney | | ☐ | | ☐ | | | 04 -James Shepherd

| | ☐ | | ☐ | | | | 05 - R. Keith Purchase | | ☐ | | ☐ | | | | 06 - Martha A.M. Morfitt | | ☐ | | ☐ | | | | | 07 - Alan C. Wallace | | ☐ | | ☐ | | | | 08 - Linda J. Welty | | ☐ | | ☐ | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | For | | Against | | Abstain | | | | | | | | | | For | | Against | | Abstain | | | | | | 2. | | Ratification of the selection of PricewaterhouseCoopers LLP as independent registered public accounting firm for 2019. | | ☐ | | ☐ | | ☐ | | | | | | 3. | | Approval of the advisory(non-binding) resolution to approve executive compensation. | | ☐ | | ☐ | | ☐ | | | | | | | | | | | | | | | | | | | | 4. | | In his or her discretion, the proxyholder is authorized to vote upon such other business as may properly come before the meeting. | | | | | | | | | | | | | | | | | | | | | | | | |

| | | B | | Authorized Signatures – This section must be completed for your vote to be counted. – Date and Sign Below |

Please sign exactly as name appears on your share certificate(s). When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

| | | | | | | | | Date (mm/dd/yyyy) – Please print date below. | | | | Signature 1 – Please keep signature within the box. | | | | Signature 2 – Please keep signature within the box. | | | | | | / / | | | | | | | | |

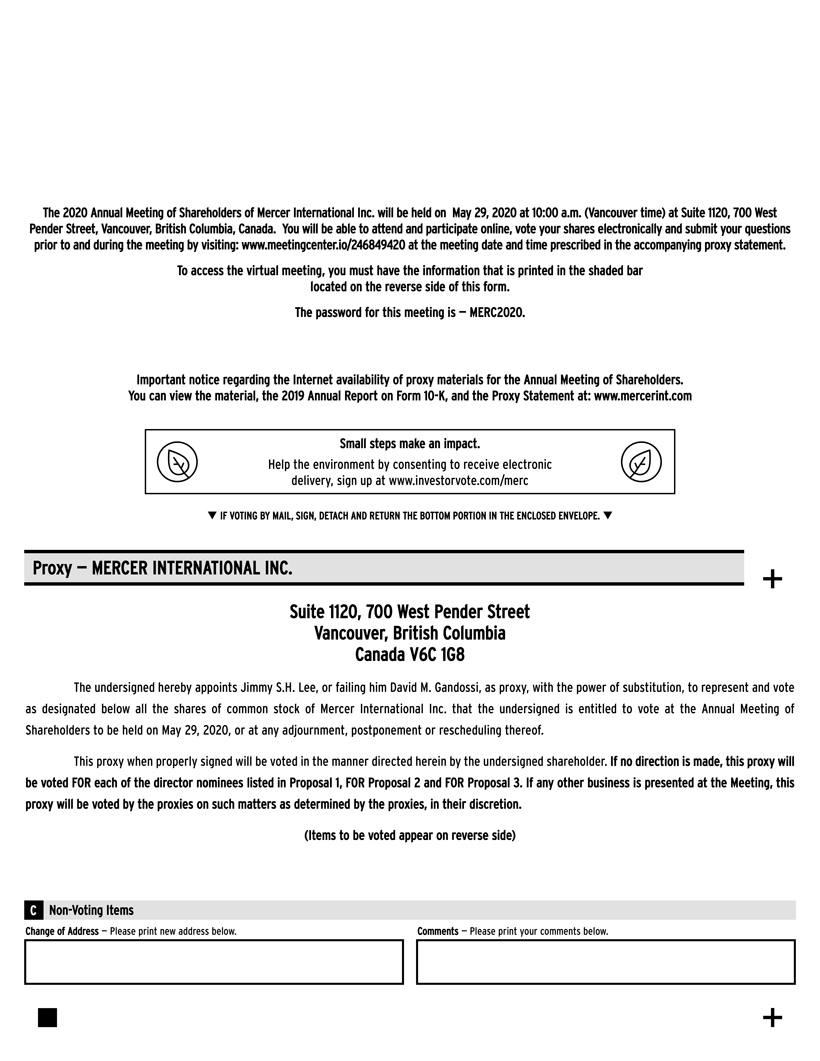

The 2019 Annual Meeting of Shareholders of Mercer International Inc. will be held on May 31, 2019 at 10:00 a.m. (Vancouver time) at Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada. You will be able to attend and participate online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetingcenter.io/244576515 at the meeting date and time prescribed in the accompanying proxy statement.

To access the virtual meeting, you must have the information that is printed in the shaded bar

located on the reverse side of this form.

The password for this meeting is – MERC2019.

Important notice regarding the Internet availability of proxy materials for the Annual Meeting of Shareholders.

You can view the material, the 2018 Annual Report on Form10-K, and the Proxy Statement at: www.mercerint.com

| | | | | | |  | | Small steps make an impact.

Help the environment by consenting to receive electronic

delivery, sign up at www.investorvote.com/merc

| |  | | |

q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.q

| | | | | Proxy – MERCER INTERNATIONAL INC. | | +

| |

Suite 1120, 700 West Pender Street

Vancouver, British Columbia

Canada V6C 1G8

The undersigned hereby appoints Jimmy S.H. Lee or failing him David M. Gandossi, as proxy, with the power of substitution, to represent and vote as designated below all the shares of common stock of Mercer International Inc. that the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held on May 31, 2019, or at any adjournment, postponement or rescheduling thereof.

This proxy when properly signed will be voted in the manner directed herein by the undersigned shareholder.If no direction is made, this proxy will be voted FOR each of the director nominees listed in Proposal 1, FOR Proposal 2 and FOR Proposal 3. If any other business is presented at the Meeting, this proxy will be voted by the proxies on such matters as determined by the proxies, in their discretion.Jimmy S.H. Lee

(Items to be voted appear on reverse side)Executive Chairman

| | | | | Date: April 10, 2020 Change of Address – Please print new address below.

| | | | Comments – Please print your comments below.

| | | | | |

| | | | |  | | | | + |

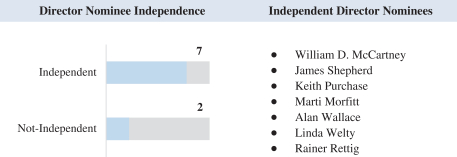

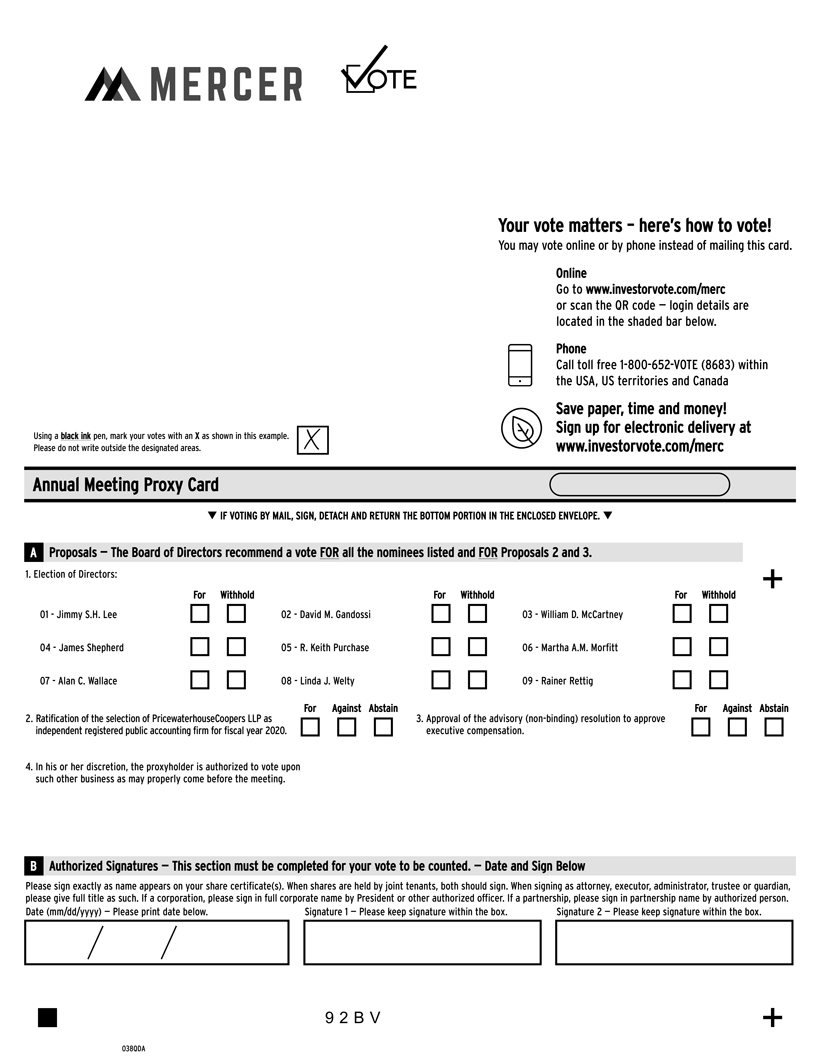

Mercer vote01—Jimmy S.H. Lee04—James Shepherd07—Alan C. Wallace02—David M. Gandossi05—R. Keith Purchase08—Linda J. Welty03���William D. McCartney06—Martha A.M. MorfittFor Withhold For Withhold For Withhold9 2 B V09—Rainer RettigUsing a black ink pen, mark your votes with an X as shown in this example.Please do not write outside the designated areas.038QDA++Proposals — The Board of Directors recommend a vote FOR all the nominees listed and FOR Proposals 2 and 3.2. Ratification of the selection of PricewaterhouseCoopers LLP asindependent registered public accounting firm for fiscal year 2020.3. Approval of the advisory(non-binding) resolution to approveexecutive compensation.1. Election of Directors:For Against AbstainPlease sign exactly as name appears on your share certificate(s). When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian,please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below4. In his or her discretion, the proxyholder is authorized to vote uponsuch other business as may properly come before the meeting.qIF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.qAnnual Meeting Proxy CardFor Against AbstainYou may vote online or by phone instead of mailing this card.OnlineGo to www.investorvote.com/mercor scan the QR code — login details arelocated in the shaded bar below.Save paper, time and money!Sign up for electronic delivery atwww.investorvote.com/mercPhoneCall toll free1-800-652-VOTE (8683) withinthe USA, US territories and CanadaYour vote matters – here’s how to vote!

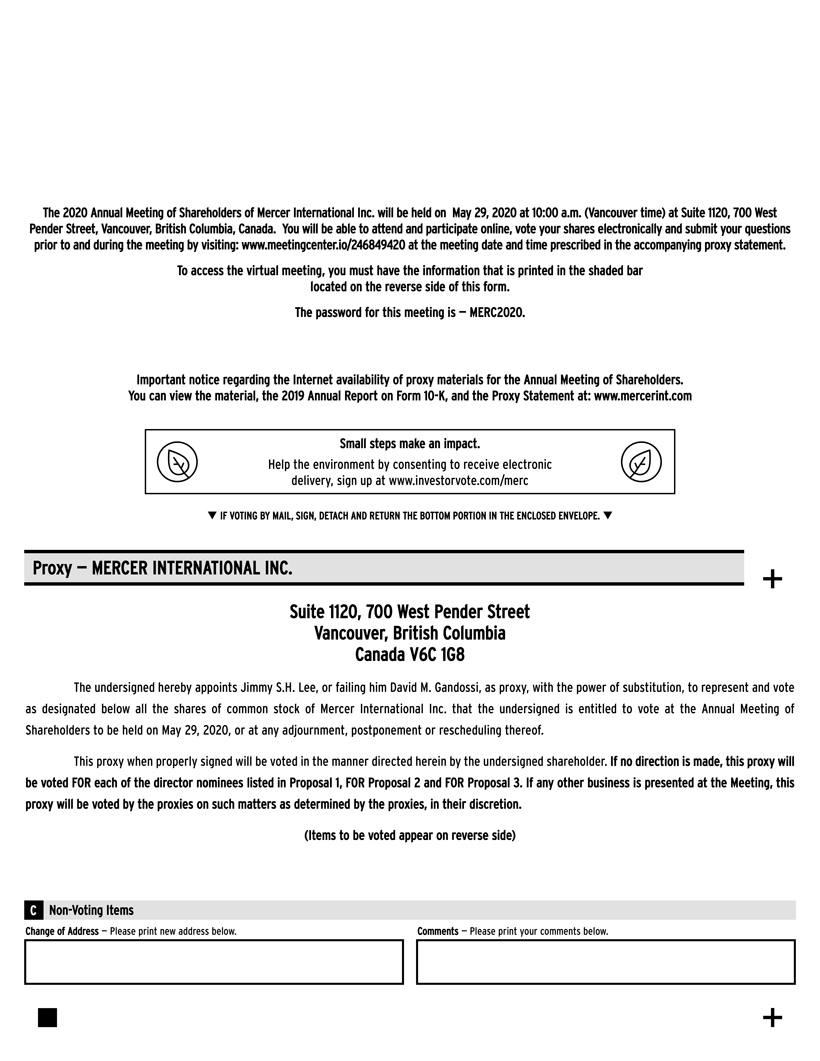

Small steps make an impact.Help the environment by consenting to receive electronicdelivery, sign up at www.investorvote.com/mercSuite 1120, 700 West Pender StreetVancouver, British ColumbiaCanada V6C 1G8The undersigned hereby appoints Jimmy S.H. Lee, or failing him David M. Gandossi, as proxy, with the power of substitution, to represent and voteas designated below all the shares of common stock of Mercer International Inc. that the undersigned is entitled to vote at the Annual Meeting ofShareholders to be held on May 29, 2020, or at any adjournment, postponement or rescheduling thereof.This proxy when properly signed will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy willbe voted FOR each of the director nominees listed in Proposal 1, FOR Proposal 2 and FOR Proposal 3. If any other business is presented at the Meeting, thisproxy will be voted by the proxies on such matters as determined by the proxies, in their discretion.(Items to be voted appear on reverse side)Proxy — MERCER INTERNATIONAL INC.qIF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.qChange of Address — Please print new address below. Comments — Please print your commentsbelow.Non-Voting Items++Important notice regarding the Internet availability of proxy materials for the Annual Meeting of Shareholders.You can view the material, the 2019 Annual Report on Form10-K, and the Proxy Statement at: www.mercerint.comThe 2020 Annual Meeting of Shareholders of Mercer International Inc. will be held on May 29, 2020 at 10:00 a.m. (Vancouver time) at Suite 1120, 700 WestPender Street, Vancouver, British Columbia, Canada. You will be able to attend and participate online, vote your shares electronically and submit your questionsprior to and during the meeting by visiting: www.meetingcenter.io/246849420 at the meeting date and time prescribed in the accompanying proxy statement.To access the virtual meeting, you must have the information that is printed in the shaded barlocated on the reverse side of this form.The password for this meeting is — MERC2020. |

|

|

FOR each director nominee

FOR each director nominee